Bangkok land price 2025 trends are defying expectations. Despite a cooling Thai economy – GDP growth is forecast around 2% this year amid weak exports and tourism – land values in the capital continue to surge to record highs. This paradox is especially pronounced in prime Bangkok districts. Property transactions nationwide have dropped (the total value of land and property deals in the first 7 months of 2025 plunged 41% year-on-year, hitting a 16-year low), yet asking prices for coveted Bangkok plots keep climbing. As seen in a 2025 Bangkok CRE forecast, investor demand for well-located land remains resilient, buoyed by long-term confidence in Bangkok’s growth. In short, a Bangkok plot shortage in key areas – combined with owner holding power – is keeping prices high even as broader real estate activity and the economy slow.

Resilient Land Prices in Late 2025: Recent Trends

Land values in Bangkok have shown remarkable staying power through 2025. After a slight dip in Q2 (the Greater Bangkok land price index fell 4.1% QoQ in Q2 2025 amid an economic lull), prices rebounded in Q3–Q4 with new benchmarks set in the central business district (CBD). According to Colliers Thailand, prime land plots are commanding record-breaking prices with no signs of discounting, and most owners are refusing to sell despite the slowdown. In fact, Bangkok’s vacant land price index was still up 4.3% year-on-year in Q2 (albeit a bit slower than the 6.2% YoY rise in Q1) – a clear sign that values remain on an upward trajectory.

New market data from late 2025 confirms the trend. Colliers reports that top CBD land prices have reached all-time highs, even as Thailand’s overall property market softens. For instance, one headline-making transaction saw Sansiri (a major developer) pay ฿3.9 million per square wah for a plot on Sarasin Road – the highest unit price ever recorded in Thailand. Similarly, land in Chidlom sold for over ฿3 million/ sq.wah, and a large Sukhumvit–Thonglor site achieved about ฿2.86 million/ sq.wah. These figures underscore how Bangkok land prices only move in one direction — up.

While ultra-prime prices soar, overall investment activity has been cautious. Higher interest rates earlier in the year and economic uncertainty led some developers to delay purchases. (Notably, Bangkok’s new city zoning plan was postponed to 2027, creating ambiguity around future land use and prompting many to postpone land banking decisions in mid-2025.) Yet by Q4 2025, with the central bank reversing course and cutting interest rates to a three-year low of 1.50%r, investor sentiment in land has picked up again. Despite subdued demand for end-property sales, high land costs are propping up prices – developers won’t sell land cheaply and replacement cost pressures (land + construction) keep values buoyant. In essence, the land market has decoupled from the short-term economic cycle. For real estate investors, this dichotomy presents both a challenge and an opportunity: Bangkok’s land market remains stubbornly strong, even as other sectors cool.

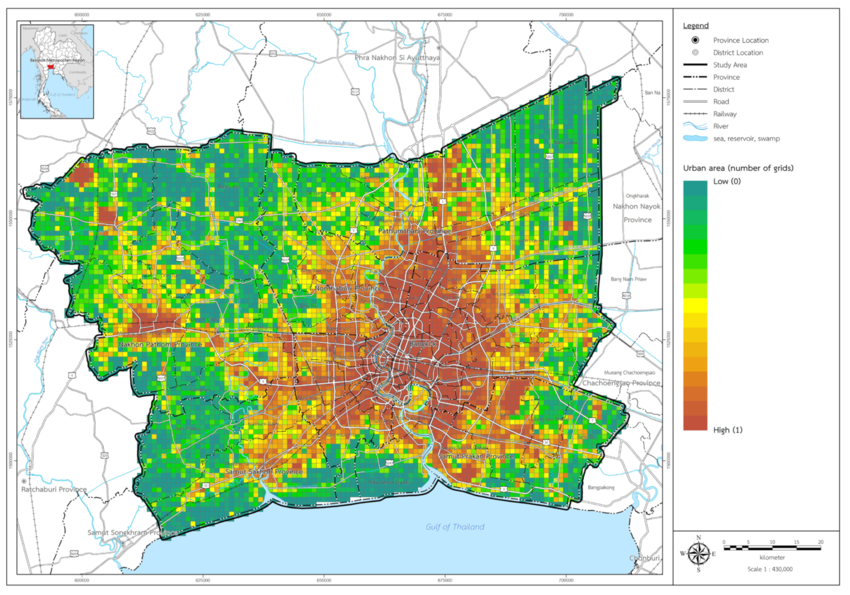

Hotspots: Bangkok’s High-Demand Districts

Certain Bangkok neighborhoods are leading the charge on land price growth, driven by intense demand and scarce supply. Both commercial and residential land segments in these locations are seeing bidding wars for the few plots that hit the market:

- CBD Core (Wireless, Chidlom, Ploenchit, Silom, Sathorn): Downtown Bangkok commands Asia-tier prices. Wireless Road now tops the charts at around ฿4,000,000 per square wah (roughly $12,000 per sq.m.) – the priciest land in Thailand – with nearby Chidlom at ~฿3.2M and Ploenchit around ฿3M per sq.wah. Historic commercial strips like Silom and Sathorn fetch ฿2.5–2.7M per sq.wah. In Sathorn’s case, a recent high-profile sale of the former Australian Embassy site (at ~฿1.45M per sq.wah) reset expectations upward; now surrounding land is valued near ฿2M per sq.wah. These CBD zones are home to luxury hotels, offices, and condos, and remain ground zero for land investment despite sky-high costs. Colliers’ research director Phattarachai Taweewong notes that Lang Suan, Silom, Sathorn, and Sukhumvit continue to be Bangkok’s most expensive addressesn, with owners there confident that values will only appreciate further.

- Sukhumvit Corridor (Asoke to Thonglor/Ekamai): This prime residential/retail strip has seen explosive land appreciation over the past decade. Plots in lower Sukhumvit (Asoke area) are in the mid-฿2 million range per sq.wah. while the Thonglor area – a chic enclave popular for upscale housing and nightlife – recently hit ฿2.6M per sq.wah asking prices. Even Ekamai and mid-Sukhumvit are around ฿1.8M/sq.wah. These neighborhoods attract both luxury condominium projects and flagship retail developments, driving demand for any available land. Developers are land-banking small house plots to assemble larger development sites here, given the area’s enduring appeal to affluent Thais and expats (as seen in our 2025 Bangkok CRE forecast for high-end residential).

- Emerging Commercial Hubs (Rama IV and Ratchada CBD Fringe): New business districts are also fueling the land price surge. Rama IV Road, which cuts past Lumphini Park and the upcoming One Bangkok project, is transforming with massive mixed-use developments – leading to sharp land value gains in its vicinity. Over on Ratchadaphisek Road (north CBD fringe), an insurance conglomerate AIA Thailand paid ฿3.5 billion for an 8-rai plot in late 2025, averaging ฿1.1M per sq.wah. This record-breaking Ratchada deal underlines how secondary business districts are now on investor radars. With new office towers, malls, and the Chinese Embassy in the area, Ratchada/Rama 9 has effectively become an extension of the CBD, and land prices reflect that dynamism.

“Bangkok’s land market remains one of the most resilient in Asia.” This structural strength is evident across prime locations, where prices rarely if ever decline once they’ve risen.

- Boutique Residential Enclaves (Ari and Beyond): Not all hotspots are in the traditional CBD. Ari, an uptown neighborhood famed for its old money estates and hip lifestyle scene, is a case in point. Land here is extremely scarce and, while cheaper than Sukhumvit, it’s rising fast – currently around ฿500k–฿600k per sq.wah, with a staggering 15% annual growth rate over the past decade and a half. Government appraisals project Ari’s land values could reach ฿725k/sq.wah by 2027, reflecting its potential. Developers have started launching luxury housing compounds in Ari to tap wealthy buyers, and larger plots are almost nonexistent. Other high-demand residential areas like Phaya Thai (near Ari) and riverside districts on the Thonburi side (e.g. around Charoen Nakhon and the new Gold Line skytrain) are also seeing upticks. The riverside in particular has boomed since icons like IconSiam mall opened, with land values leaping due to improved infrastructure and lifestyle appeal. Overall, any Bangkok neighborhood combining good transit access, lifestyle amenities, and limited available land is experiencing aggressive price growth – a trend astute investors are watching closely.

Scarcity, Hoarding, and Other Drivers Behind the Surge

Why are land prices rising in Bangkok even as the broader economy loses steam? The answer lies in structural factors that limit supply and sustain demand:

- Absolute Scarcity of Prime Land: Bangkok’s urban core is largely built-out, and undeveloped plots are extremely limited. What’s left is often tightly held by long-time owners. This fundamental Bangkok plot shortage means even if fewer buyers are in the market, those rare prime plots that do become available still fetch top dollar. Many landlords understand that replacement land in central Bangkok simply doesn’t exist – you can’t create new land in Sukhumvit or Sathorn – so they hold out for ever-higher prices. The result: values ratchet upward with each landmark sale, and downturns barely dent the trajectory.

- Landowner “Hoarding” & Holding Power: Unlike highly leveraged markets, Bangkok’s land ownership is dominated by entities with patience – wealthy families, major corporations, and government agencies – who are under little pressure to sell. Colliers notes that most owners in prime areas are refusing to sell and instead exploring leasehold or joint venture options. Phattarachai Taweewong of Colliers observed that many owners prefer to “monetise their land through partnerships rather than permanent sales,” ensuring they retain ownership while still capitalizing on rising values. This trend of land leasing and JV developments (particularly for central plots) effectively keeps freehold supply off the market, contributing to the price surge. Even the introduction of Thailand’s new Land and Building Tax – aimed at discouraging idle land – has only modestly pried loose some holdings. A few owners facing high tax bills have gradually sold land to reduce carrying costs, but in the top locations deep-pocketed owners simply absorb the taxes as the cost of doing business (often offset by interim uses or rental income). In short, land banking Thailand-style is alive and well: those who own prime plots are playing the long game.

- Zoning Restrictions and Delayed Plan Boost Future Value: Bangkok’s city planning regime limits high-density development to certain zones, which concentrates value in specific areas. For example, central district land with high Floor-Area-Ratio (FAR) allowances is especially prized – developers can build tall towers and thus pay more for the land. The postponement of Bangkok’s new city plan to 2027 added a layer of uncertainty this year, causing some developers to pause acquisitions. Many had hoped the new zoning plan might open up new development nodes or higher densities; its delay kept prime land supply tight under the old rules. Conversely, any future upzoning or infrastructure (like new mass transit lines) instantly boosts land values in affected locales – historically, transit announcements alone have led to ~25% land price jumps on average. This speculative angle means owners and investors hold land awaiting the next zoning “unlock”, further restricting current supply. In essence, policy and planning constraints are baking in the scarcity premium on Bangkok land.

- Capital Markets and Investor Confidence: Interestingly, the very factors hurting the broader economy have, in some ways, buttressed land prices. With Thai GDP sputtering, authorities have eased monetary policy – interest rates are low, reducing holding costs for big developers and making real estate investment attractive relative to low-yield financial assets. Major developers and institutions also continue to have access to capital (through equity, bonds, or joint ventures), allowing them to invest in land for the long term. Colliers pointed out that strong demand from major listed developers and private investors has kept the land market buoyant. These well-capitalized players view prime Bangkok land as a safe haven asset – a hedge against inflation and currency shifts, given its historical performance. Indeed, one could argue that in an uncertain macro environment, prime land’s tangible value becomes even more appealing. Local banks might be cautious on consumer mortgages, but they still finance reputable developers, and some investors rotate capital out of volatile markets into property. All this means the Thailand commercial land investment scene in Bangkok is dominated by those confident in the city’s long-run prospects. Colliers encapsulated this sentiment, noting “Bangkok’s land market remains one of the most resilient in Asia” and that land values here “rarely decline once they have risen”. Such confidence creates a self-fulfilling prophecy: few expect prices to fall, so few are willing to sell at anything less than a premium.

How Investors Are Navigating the Boom

For real estate investors, the current environment calls for savvy strategies. With land costs at historic highs, both institutional and mid-tier players are adjusting their approach:

- Land Banking & Long Holds: Big developers continue land banking in strategic locations – even if they don’t build immediately. Acquiring scarce plots now (or assembling land over time) is seen as positioning for the next upcycle or future projects. Some listed firms paused purchases in mid-2025 due to uncertainty, but most will pounce on prime opportunities knowing that today’s high price could look like a bargain in a few years. Long-hold plays suit institutional investors (insurance companies, funds, family offices) who can park capital in land and patiently wait for values to mature. Bangkok’s track record rewards patience: someone who bought land a decade ago likely sees a substantial gain today. This favors investors with deep pockets and long investment horizons. As a result, the market tilts toward institutional investors and large developers – those who can afford to buy prime land and hold or develop it at scale.

- Leveraging Partnerships and Creative Deals: Mid-tier developers, who often can’t afford 8- or 9-figure land purchases alone, are adapting by teaming up. Joint ventures with land-owning families or equity partners are increasingly common. For example, rather than buying a downtown plot outright, a smaller condo developer might partner with the landowner – the owner contributes the land to the project, and the developer brings capital/expertise, with profits shared. This reduces upfront land cost while still allowing access to prime sites. Land lease deals (long-term leaseholds) are another strategy – investors secure usage of prime land for 30-90 years without paying for the title, which costs far less than buying the freehold. These approaches enable mid-sized players to stay in the game despite high prices. They also appeal to landowners, as noted, who get to monetize without selling. In essence, flexibility and partnerships are key for anyone but the largest buyers.

- Maximizing Density and Value-Add: Given the steep land acquisition costs, developers are focused on making every square meter count. Projects on expensive land are typically high-density and high-value: think luxury condominiums, Grade A offices, or mixed-use complexes that yield strong revenue per square wah of land. Investors are employing “density use” strategies – building taller towers, adding more units, or incorporating multiple uses (residential + retail + hotel) on a single plot – to boost returns. For instance, a developer who pays a record price for a Sukhumvit site might design an ultra-luxury condo with sky-high unit prices, ensuring the project remains profitable. Others might pursue urban redevelopment: buying older low-rise buildings on valuable land, tearing them down, and constructing modern high-rises that fully leverage the land’s worth. Essentially, in this environment only the most efficient and high-yield projects pencil out on costly land. Investors who can creatively add value – through design, branding, or new concepts – can justify the land expense. Those who cannot will find it tough to compete.

So, who does this market favor? Clearly, the advantage lies with institutional investors and well-capitalized developers. These players can outbid others for prime sites, secure financing, and weather any short-term market dips. Mid-tier developers and newcomers face challenges – they either adapt via niche strategies (targeting city-fringe areas, smaller boutique projects) or partner with bigger fish to access prime land. The upside for smaller investors is to look where big firms aren’t: emerging neighborhoods, up-and-coming transit suburbs, or specialized segments (e.g. townhouses, co-living, renovations) where land is cheaper and competition lighter. Still, the overarching theme is that Bangkok’s land boom favors those with patience, creativity, and strong capital backing. The legendary “City of Angels” real estate is not for the faint of heart in 2025 – but for those who strategize well, it remains immensely rewarding.

Outlook: Still Surging Ahead

Looking forward, most analysts foresee Bangkok land prices continuing to rise into 2026 and beyond. Colliers, for one, projects further increase in CBD land values in 2026 and emphasizes that Thailand’s land prices “rarely decline once they’ve gone up”. While the broader property market may stay sluggish until the economy picks up, the structural drivers – limited prime supply, ambitious investors, and Bangkok’s enduring magnetism – will likely keep land on its upward trajectory. In a sense, the current slowdown might even be an opportunity: those investors who can secure land during the quieter period could be poised to reap outsized gains when growth rebounds.

For real estate investors eyeing Thailand commercial land investment, the key is discernment. Focus on locations with undeniable long-term appeal, partner wisely, and be prepared to hold for the long run. Bangkok’s land market paradox – soaring prices amid a slowing economy – ultimately reflects a vote of confidence in the city’s future. Investors who understand that paradox, and navigate it intelligently, can position themselves ahead of the next wave.

Like what you read here? Claim your Lifetime Premium Access — (limited time offer). Subscribe now at The Thailand Advisor.