Thailand’s tourism industry stumbled in 2025, marking the first post-Covid slump as visitor arrivals fell sharply from the wave of pent-up demand. Notably, Chinese arrivals – Thailand’s top market – plunged roughly 34% in early 2025, and overall foreign arrivals are running about 7% below last year. The IMF has pared back GDP growth to roughly 2% for the year. With tourism fading as the engine of growth, Thailand is desperately seeking new drivers. Ironically, Bangkok has simultaneously topped a global survey of digital nomad cities, and officials say this #1 ranking “confirms [the] city has the strong potential to serve as a center for high-quality work and lifestyle”.

“Bangkok being ranked number one for digital nomads confirms our city has the strong potential to serve as a center for high-quality work and lifestyle,” a city official notes.

Despite the tourism shock, Thailand’s pivot is clear: treat outsiders not just as visitors but as potential residents. The government has rolled out five-year Destination Thailand Visas (DTV) for remote workers, relaxed long-term residency (LTR) rules for high-earners, and even launched a one-year Smart Visa for tech executives. Expats can now work remotely with no Thai work-permit under these visas. Meanwhile, Thailand is wooing investors: corporate rules are loosening (see [Thailand Eases Foreign Business Rules: Bold Reform or Half Measure?]), and the Board of Investment is fast-tracking projects. On the property front, foreigners are eyeing condos and villas from Bangkok to Phuket as second homes or revenue-generators. As one TTA story observes, “with new long-stay visas [and] easy property ownership… Thailand is becoming the world’s favorite second home”. Listings of Thai real estate (residential and commercial) on platforms like Lazudi are soaring, suggesting foreign cash is flowing in even as hotels risk empty rooms. In short, Thailand hopes these newcomers’ spending and investments will help offset missing tourist dollars – but questions linger over whether high prices and red tape might keep out all but the well-heeled.

Visa Overhaul: Digital Nomads & Long-Term Residents

Facing economic headwinds, the Thai government has simplified its visa system and launched programs to attract foreign talent. In late 2025 it merged 17 non-immigrant visa categories into seven, streamlining renewals and work-permit processes. At the same time, it introduced the 5-year Destination Thailand Visa (DTV): a digital-nomad visa with minimal fees, permitting freelancers to live here up to 180 days at a time without needing a Thai work permit. Anecdotes from expatriate forums capture the enthusiasm: “Finally, a visa that truly understands the needs of digital nomads,” wrote one satisfied holder. Thailand is also promoting a 10-year Long-Term Residency (LTR) visa for rich investors, streamlining accounts and visas for high-income foreigners.

“Various government agencies, including the Board of Investment, have approved the cabinet’s proposal” to ease foreign investment rules, reflecting the official push to attract outsiders.

The reforms go hand-in-hand with corporate incentives. The Board of Investment is expediting hundreds of billions in projects (especially in data centers, electronics and green energy). Corporate services firms stand ready to help foreigners set up here – for example, Siac Consulting advertises end-to-end company formation, work permits and visa assistance for foreign entrepreneurs. Specialist agents like Lazudi help non-Thai buyers navigate ownership restrictions and market listings. In theory, these measures aim to make Thailand as easy to live and do business in as its neighbors. Yet lawyers and accountants note a learning curve: the e-work permit system is new, and banks have grown stricter on visa compliance. As we reported in “Thailand’s Visa Overhaul 2025”, this is essentially a tidy-up of paperwork, not a complete upheaval. Expat experts advise newcomers to plan carefully and use professional guidance to avoid surprises.

“This surge in investment reflects growing confidence in Thailand’s strategic focus on future industries,” proclaimed a deputy government spokesman after noting a 43% jump in foreign project approvals in early 2025. The influx confirms there is appetite among foreigners to bet on Thailand’s long-term stability and growth.

Investing in Thailand: Property and Business

For many expats and foreigners, the strategy pivots on property and entrepreneurship. Residential real estate has long been cheaper than in the West, and recent years saw rich foreigners scooping up luxury villas and condos. Coastal locales like Phuket and Hua Hin – previously considered retirees’ havens – are now filled with Airbnb-style rentals and high-end developments, as covered in our piece on Hua Hin holiday rentals. Bangkok’s market is even tighter: prime plots in Sukhumvit and Silom keep hitting record prices (for example, a recent sale set a Thailand land-price record). Our TTA analysis “Why Bangkok Land Prices Are Still Surging” showed that despite soft demand for homes, investor confidence is keeping city values aloft, underscoring a real estate boom that defies the broader slowdown. Commercial property is also in focus: foreign firms are setting up regional offices, fueling rents in tech parks and coworking spaces.

Behind the scenes, company law is shifting to ease foreign entrepreneurship. Thailand’s notorious “49% rule” (which limited most Thai companies to 49% foreign ownership) is poised to loosen for the first time in decades. This means one day a foreigner could legally hold majority stakes in sectors like manufacturing or services – a radical change from the past. Authorities hope that by cutting nominee-shareholder schemes and simplifying licenses, more global capital will flow in. Nevertheless, analysts caution this won’t happen overnight: detailed regulations are still pending, and banks may remain cautious on new accounts.

Stay Connected: E-SIM and Travel Logistics

Staying in Thailand isn’t just about visas and investments – connectivity matters too. The government has digitized entry: a new Digital Arrival Card (TDAC) is mandatory for all visitors since May 2025, intended to streamline immigration and health checks. Meanwhile, internet infrastructure has been beefed up in major cities, with 5G now available in Bangkok, Chiang Mai and other expat hubs. Travelers and nomads can maintain local connectivity easily via e-SIMs: for example, services like Breeze offer Thailand eSIM data plans so that visitors can use their phones right away without swapping physical SIM cards.

Meet Breeze — the easiest way to stay online in Thailand.

No plastic SIMs. No queues. Just instant data when you land.

Skip the airport SIM hunt. With Breeze eSIM, you’re connected the moment you arrive. Choose your plan, scan your QR, and enjoy fast data across Thailand — prepaid, secure, and hassle-free.

Travel smarter. Stay connected with Breeze.

Planning a trip is also simpler. In partnership with Expedia, The Thailand Advisor provides travel tools to book flights and hotels. You can click the Expedia widget below to find cheap flights to Bangkok or hotels in Phuket. For instance, Expedia allows travelers to compare hundreds of airlines and dozens of hotels up to a year in advance. Whether arriving for a week-long holiday or settling in for a year of remote work, online booking platforms now let you tailor packages with lodging, car rental and flights in one place.

“Thailand is simplifying travel and residency into a smoother experience,” notes one expat blog. “From e-visas and digital arrival cards to eSIMs and co-working, it’s easier than ever to plug in from anywhere.”

Subscribe Today for More Insights: Love in-depth reports? Sign up for free now and get future members-only articles. For example, our next exclusive piece might explore “Thailand’s Next Silicon Valley: Rising Tech Hubs Beyond Bangkok”. Limited-time offer – become a premium member today!

Sources: Thomson Reuters: Thailand’s BOI to speed up 300B baht in projects over 4 months | Thai Government Press (translated): Jan–Apr 2025 foreign investment up 43% YoY | IMF World Economic Outlook: Thailand GDP growth ~2.0% for 2025.

Read next: Why Bangkok Land Prices Are Still Surging — Even With a Slowing Economy

Magazine Cover Prompt

Cover Title: Thailand 3.0: Beyond Beaches to Business

Cover Description: As Chinese tourism wanes and economic growth stalls, Thailand is making a bold pivot: courting digital nomads, investors and retirees with new long-stay visas, property incentives and relaxed rules. Don’t miss our deep dive into the country’s quiet transformation — the trends you need to know to keep up.

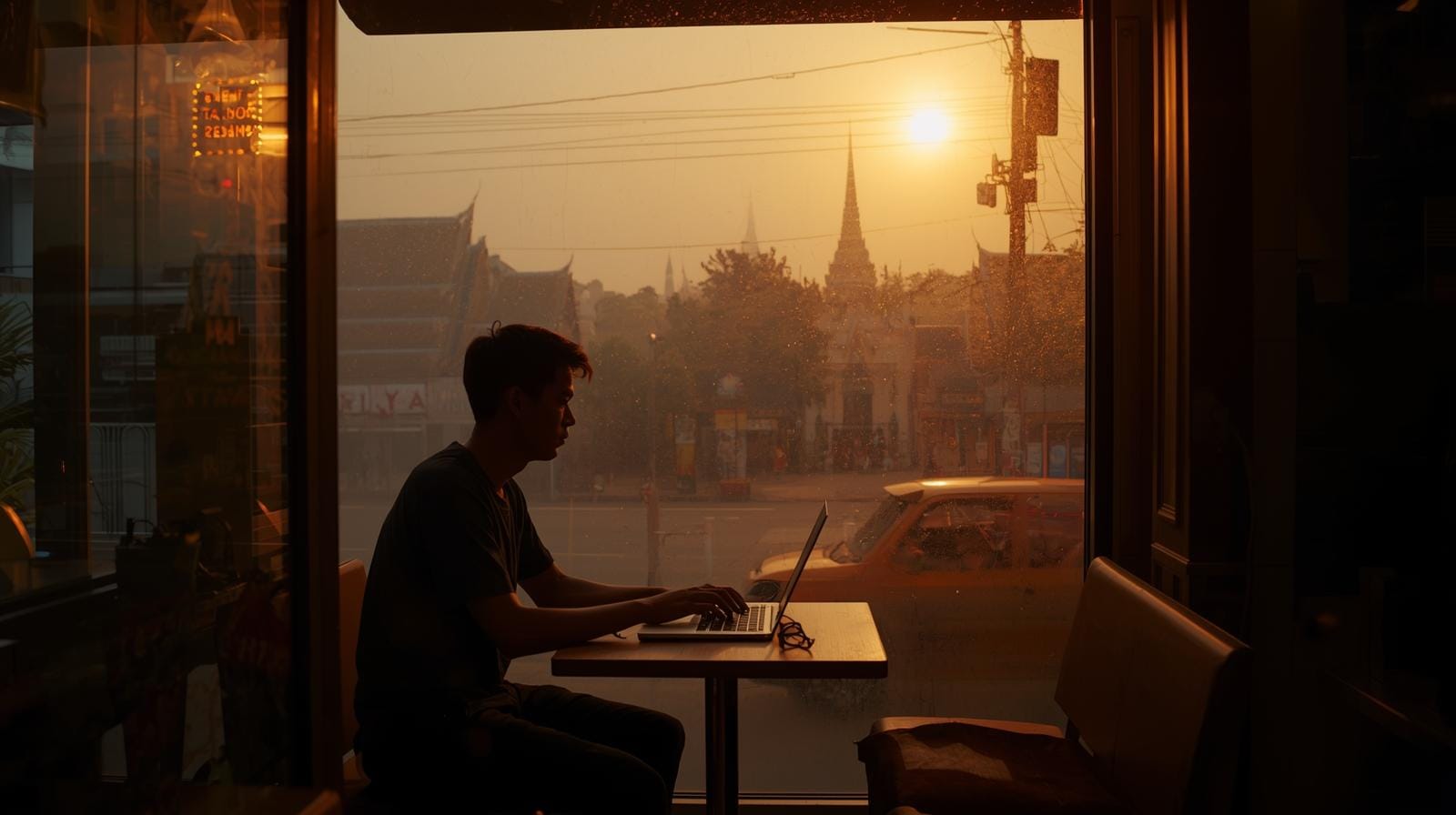

Image Prompt: A Leica-style, vertical (3:4) portrait of a foreigner at golden hour in Thailand: a young professional sits on a rooftop terrace in Chiang Mai at sunset, laptop open and Thai cityscape behind her. The light is warm and cinematic, and in the background a distant temple spire and lush hills are out of focus. The mood is hopeful and introspective, capturing Thailand’s blend of ancient charm and modern ambition.

About The Thailand Advisor: We believe you deserve more than headlines. The Thailand Advisor is an independent source that digs beneath the surface, delivering clear, data-driven insights on Thailand’s economy, culture and policy. We stand for in-depth analysis that empowers readers like you – global citizens, expats, investors and curious travelers – to understand and shape Thailand’s future. Join our community: subscribe, share your voice, and become part of the conversation, because Thailand’s story is still being written, and you can help write the next chapter.